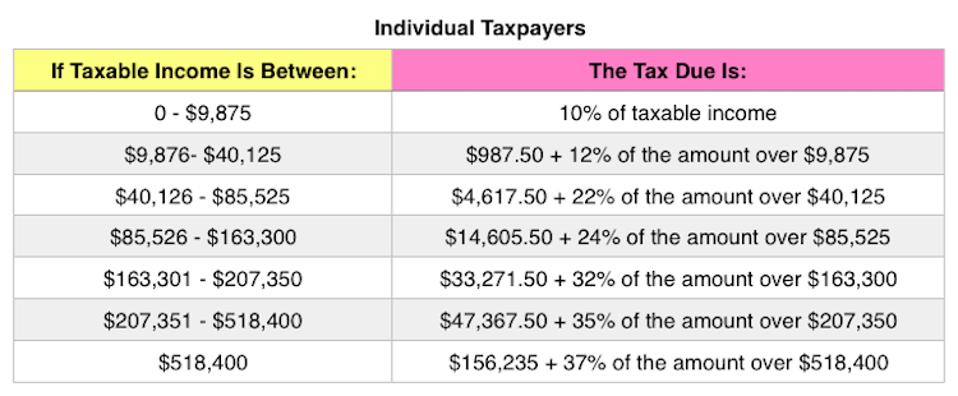

Unfortunately, the means of managing lengthy-time period capital gains and odd income tax brackets is messier when there is a mix of every – which in follow is common, as most taxpayers which have capital positive factors have at the least some ordinary earnings as properly. A long-time period capital gain is made on an asset you owned for a minimum of 366 consecutive days. The measure, authorised overwhelmingly by the Senate on Wednesday, was expected to provide no less than a short-time period increase to the U.S. The U.S. Congress gave last approval late final night time to the deal President Barack Obama. Since U.S. government bond funds are composed of securities backed by the creditworthiness of the U.S. Meanwhile, long-time period capital beneficial properties are taxed at one of three potential rates — and all are a lot decrease than the corresponding marginal tax rates. Generally lower marginal tax charges and completely different revenue thresholds for many tax brackets combine to provide a possible short-term capital features tax reduce for many Americans. Under the Tax Cuts and Jobs Act, the three capital features income thresholds don’t match up perfectly with the tax brackets.

Unfortunately, the means of managing lengthy-time period capital gains and odd income tax brackets is messier when there is a mix of every – which in follow is common, as most taxpayers which have capital positive factors have at the least some ordinary earnings as properly. A long-time period capital gain is made on an asset you owned for a minimum of 366 consecutive days. The measure, authorised overwhelmingly by the Senate on Wednesday, was expected to provide no less than a short-time period increase to the U.S. The U.S. Congress gave last approval late final night time to the deal President Barack Obama. Since U.S. government bond funds are composed of securities backed by the creditworthiness of the U.S. Meanwhile, long-time period capital beneficial properties are taxed at one of three potential rates — and all are a lot decrease than the corresponding marginal tax rates. Generally lower marginal tax charges and completely different revenue thresholds for many tax brackets combine to provide a possible short-term capital features tax reduce for many Americans. Under the Tax Cuts and Jobs Act, the three capital features income thresholds don’t match up perfectly with the tax brackets.

The 2018 lengthy-term capital positive aspects tax construction might change considerably if the GOP passes a tax reform bill. Here’s what traders need to find out about how the Tax Cuts. However, investors with lower than $10 to report is not going to receive one. Congress recently handed the Tax Cuts and Jobs Act, so it appears that sweeping tax adjustments are set to go into effect in 2018. While the bill makes plenty of adjustments to our individual tax code, one concern to traders is the capital gains tax. To be clear, we don’t have a single tax reform plan but, and the eventual changes will seemingly be a compromise between the House and Senate versions of the Tax Cuts and Jobs Act, which are fairly totally different at this point, so there is not any method to know what sort of adjustments might be in store. If your marginal tax rate has changed, your quick-term capital features tax will change as nicely. Here’s a rundown of the capital good points tax construction for 2018, and how you could possibly be affected. Under earlier tax legislation, the 0% price was applied to the two lowest tax brackets, the 15% charge was utilized to the following four, and the 20% price was applied to the highest bracket.

The 2018 lengthy-term capital positive aspects tax construction might change considerably if the GOP passes a tax reform bill. Here’s what traders need to find out about how the Tax Cuts. However, investors with lower than $10 to report is not going to receive one. Congress recently handed the Tax Cuts and Jobs Act, so it appears that sweeping tax adjustments are set to go into effect in 2018. While the bill makes plenty of adjustments to our individual tax code, one concern to traders is the capital gains tax. To be clear, we don’t have a single tax reform plan but, and the eventual changes will seemingly be a compromise between the House and Senate versions of the Tax Cuts and Jobs Act, which are fairly totally different at this point, so there is not any method to know what sort of adjustments might be in store. If your marginal tax rate has changed, your quick-term capital features tax will change as nicely. Here’s a rundown of the capital good points tax construction for 2018, and how you could possibly be affected. Under earlier tax legislation, the 0% price was applied to the two lowest tax brackets, the 15% charge was utilized to the following four, and the 20% price was applied to the highest bracket.

New commitments to venture capital companies accelerated from $sixty eight million in 1977 when the highest marginal charge was 49 percent to $5.1 billion by 1983 when the rate had been dropped to 20 p.c. Nebraska remains one in all only six states that continues to levy an inheritance tax, and its prime inheritance tax fee of 18 percent is the very best in the nation. Start getting out of tax debt at the moment. Nebraska should work to repeal its inheritance tax and might begin by increasing its de minimis exemptions and reducing the exorbitantly high fee on bequests to non-relations. Repeal the capital inventory tax. Gov. John Bel Edwards on Monday signed the tax-swap package deal of bills that, if permitted by Louisiana voters, will repeal the federal tax fee deduction allowed on state income tax returns in exchange for decrease state tax rates for people and corporations. In different phrases, your lengthy-time period capital beneficial properties taxes in 2018 will be nearly the same as they would have been if no tax reform invoice was handed. Also, for each types of capital beneficial properties, it is worth noting that the 3.8% internet investment income tax that applies to sure excessive earners will stay in place, with the very same income thresholds.

Any earnings that the trust doesn’t distribute in the same yr that it’s earned is taxed and then added to the trust’s principal. A capital acquire happens when an investor buys a capital asset for a specific price and then sells it for a better value. If you are single and all your taxable income provides as much as $40,000 or much less in 2020, then you will not should pay any tax in your lengthy-term capital features. His concept to tax unrealized capital beneficial properties at death has also misplaced steam among some in his get together. The point is that the lengthy-term capital beneficial properties tax rates discussed here reflect the present tax law, and there’s a possibility that this information might change. Capital features are a good way to obtain money to stay on from your investments. Tax deductions are highly effective components of a tax return, allowing you to trim your tax bill and keep extra money in your pockets.