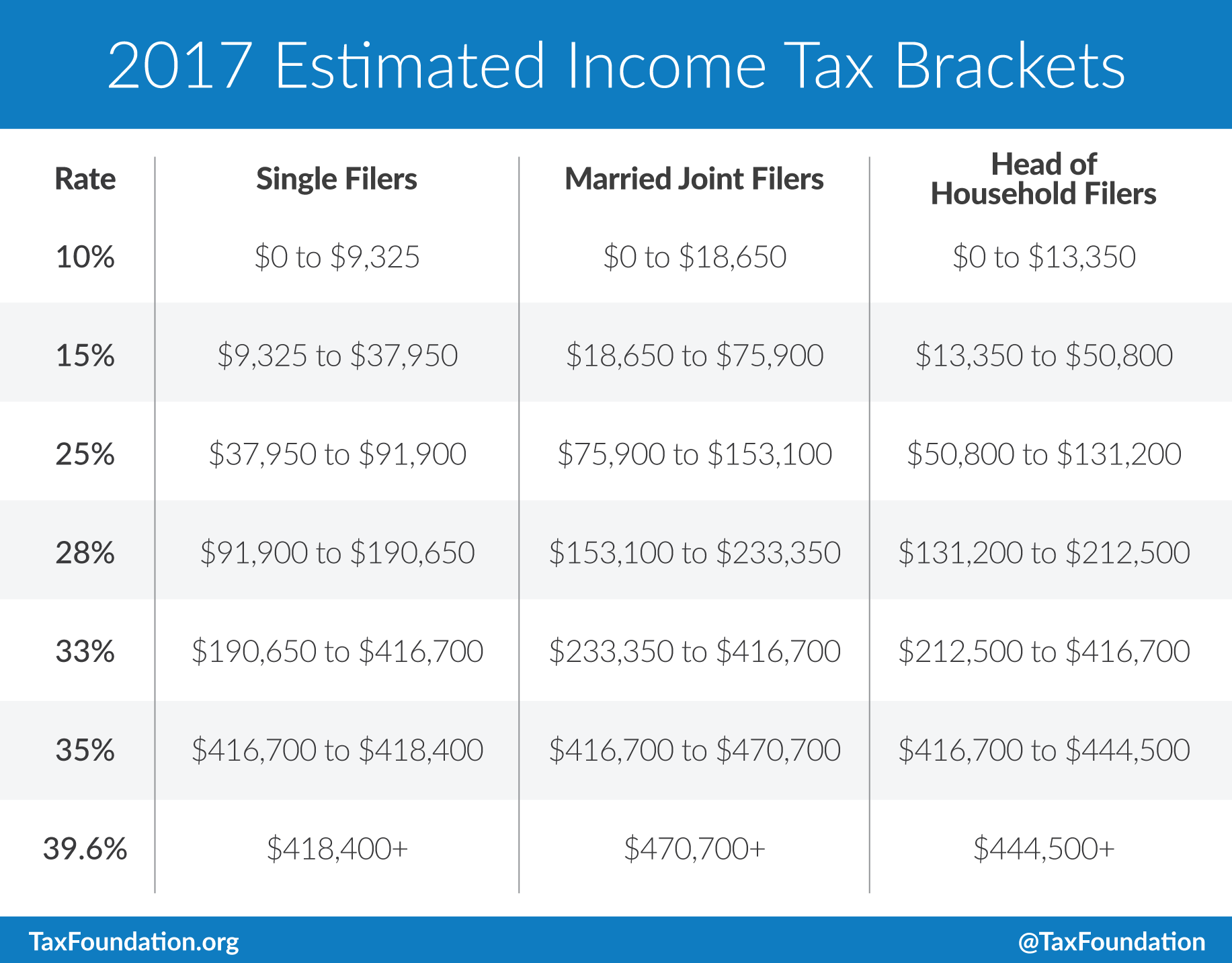

The panel plans to mark up its bill the week of November 13, sources say, and have it on the floor the week after. GOP senators have been engaged on a “buddy system,” sources say, with committee members serving as liaisons for his or her colleagues. Trump tweeted. The Republican House members are working laborious. Trump himself tweeted in regards to the bill, highlighting congressional Republicans’ efforts. Republicans negotiating the SALT say they’ve concepts to vary it. One key growth as of Tuesday: Republicans plan to keep a top income tax rate of 39.6% for people in the expected tax reform plan, a transfer designed to uphold promises made by President Donald Trump that any tax cuts would not profit high revenue earners. Of concern had been issues surrounding retirement savings and the state and local tax deduction, two key provisions that contain raising revenue to pay for the plan. While the invoice is expected to preserve the property tax deduction, leaders will nonetheless hashing out the final details Tuesday evening across the deduction, according to multiple sources, together with whether a cap could be positioned on the amount that might be deducted.

When the closing papers are signed, the sale of your home is over – a minimum of until tax season rolls around. Anyone who watched well being care would say no. But, at least at the moment, they are going to offer it a shot. The SALT deduction is utilized by filers who itemize deductions. The asset is moved into an irrevocable trust previous to sale, and a direct charitable revenue tax deduction becomes available. Bias for or towards either plan aside, the overall declare is that the tax structure helped fund social applications underneath FDR and stimulated the economy below Reagan. TIP: We need money to make the financial system work. Ryan, in accordance with a number of sources, informed conservative leaders in the meeting that the bill will keep the highest rate, however it might apply to people who make considerably more money than those that presently pay the same charge. The Washington Post first reported that the highest price would remain.

When the closing papers are signed, the sale of your home is over – a minimum of until tax season rolls around. Anyone who watched well being care would say no. But, at least at the moment, they are going to offer it a shot. The SALT deduction is utilized by filers who itemize deductions. The asset is moved into an irrevocable trust previous to sale, and a direct charitable revenue tax deduction becomes available. Bias for or towards either plan aside, the overall declare is that the tax structure helped fund social applications underneath FDR and stimulated the economy below Reagan. TIP: We need money to make the financial system work. Ryan, in accordance with a number of sources, informed conservative leaders in the meeting that the bill will keep the highest rate, however it might apply to people who make considerably more money than those that presently pay the same charge. The Washington Post first reported that the highest price would remain.

Ryan announced earlier this month that the plan would in reality embody the fourth charge, however he declined to say what the rate can be on the time. Democrats have been demanding that the plan assist only the middle class, not the wealthy. States that have not already acted to enhance their tax competitiveness ought to consider how they, too, can use their sturdy fiscal condition to make meaningful tax reforms that can assist their state compete for business investment and entice and retain new residents, especially as distant work has turn into extra common. The state allows filers to deduct both 40% of capital positive aspects income or $1,000, whichever is larger. You don’t actually calculate your tax with this type; you solely list your net features and losses. A White House aide mentioned the administration is just not worried about the one-day delay in unveiling the tax plan, saying it permits House members extra time to debate the language and resolve variations. The five categories allowed by the IRS beneath which taxes can be filed are married filing jointly, single, head of family, married taxpayer filing separately, and qualifying widow or widower with a number of dependent youngsters.

Ryan announced earlier this month that the plan would in reality embody the fourth charge, however he declined to say what the rate can be on the time. Democrats have been demanding that the plan assist only the middle class, not the wealthy. States that have not already acted to enhance their tax competitiveness ought to consider how they, too, can use their sturdy fiscal condition to make meaningful tax reforms that can assist their state compete for business investment and entice and retain new residents, especially as distant work has turn into extra common. The state allows filers to deduct both 40% of capital positive aspects income or $1,000, whichever is larger. You don’t actually calculate your tax with this type; you solely list your net features and losses. A White House aide mentioned the administration is just not worried about the one-day delay in unveiling the tax plan, saying it permits House members extra time to debate the language and resolve variations. The five categories allowed by the IRS beneath which taxes can be filed are married filing jointly, single, head of family, married taxpayer filing separately, and qualifying widow or widower with a number of dependent youngsters.

Currently, the structure requires a deduction of federal taxes paid for purposes of computing state tax returns. Last month, Congress handed Joe Biden’s $1.9 trillion COVID relief package which saw New York state authorities receive $12.5 billion and New York City $6.1 billion. It’s estimated to free up greater than $1 trillion in income. In addition, the interior Revenue Service uses figures for the year ended Aug. 31 to determine the next-year’s tax tables, and inflation surged this fall. Tax reform is tough. One of many administration’s signature messages in selling their tax reform framework was that it will assist the middle class. Republican Rep. Tom MacArthur, of latest Jersey, which has the best property tax within the country, said he does not consider the House will move a closing tax reform invoice with out a change. It’s 100% true that should you have been working offshore and had zero or little or no tax, you probably want a new plan and tax technique.